“Never

invest in a business that you cannot understand” -Warren

Buffet

Historically, it was the financial professionals who had the

easiest access to corporate data. Today

this has all changed, thanks to the SEC.

The SEC’s interactive disclosure standards have leveled the investment playing

field and brought Buffet’s quote within the reach of every investor. A stated objective of

the SEC is:

“As more companies embrace

interactive data, sophisticated analysis tools now used by financial

professionals could become available to the average investor.” -

What is really implied by this objective?

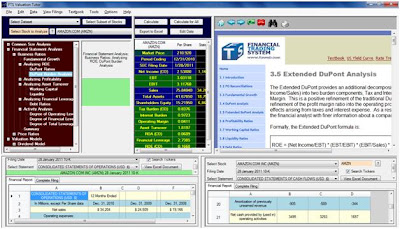

Consider the following Valuation Tutor application screen that

sits on top of the SEC’s interactive data:

There are four major components to this screen. The top Right Hand Side (RHS) provides the

conceptual framework and analytical tools, designed to operate and transform interactive

data into information. The top Left Hand Side (LHS) is an online

text that provides the concepts and operational steps required for working with

the top RHS. The bottom LHS and RHS

provide immediate access to the interactive data itself. Simply, enter the stock’s ticker and an

amazing amount of data is suddenly available.

For example, consider Amazon.com (AMZN). By entering the stock ticker AMZN, Valuation

Tutor immediately pulls in the following list of reports:

Suppose you want the latest 10-K which at the time of this

blog was filed on the 28th January 2011 as illustrated above. By selecting this report the following list

is now available to an investor:

The above is only a partial list as you can see from the

scroll bar there is a lot more that can be scrolled down to.

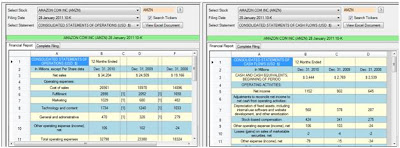

Suppose you select the Consolidated Statement of Operations

for Amazon. This further provides access

to the following:

Or similarly, you may be interested in comparing this with

Amazon’s Cash Flow Statement. You can

pull these up side-by-side:

By clicking on View Excel Document in either window provides

immediate access to this data in Excel for further processing.

Finally, to understand what Amazon’s business model and

business strategy actually is you can further give yourself immediate access to

the 10-K report itself. This requires a

couple of steps, click on the menu item

View Filings and select either SEC Filing Viewer on Right or SEC Filing Viewer

Popup as illustrated below:

The popup is useful if you have the luxury of two screens

but even on a single screen it is very powerful. The Viewer appears as follows (I have entered

AMZN as the ticker again):

In the above LHS the two tabs are Financial Report and

Complete Filing. The financial report is

as described before but the Complete Filing now provides immediate access to

the 10-K report by scrolling down as follows:

To read the 10-K, click on the hyperlink under the Document:

Finally, on the RHS of the screen is the tab Data

Collector. This can be used to design

your own Excel Spreadsheet. Instead of

dumping out all fields you can be selective across statements. Click on Financial Report in the LHS of the

screen and bring up Amazon’s Consolidated Cash Flow Statement then click on

Data Collector on the RHS and the screen appears as follows:

You can now decide what fields you want dumped into Excel by

simply double clicking on a row in the LHS.

You can work across statements as well so that you are mixing and

matching from the Balance Sheet, Income Statement and Cash Flow or other

statements. For an example, suppose I

double click on Net Income, Net Cash used in Operating Activities, Investing

Activities and Financing Activities then the following appears in the RHS:

Finally, click on Copy All and Paste into Excel to provide

the following spreadsheet ready for use:

The original architects of the 1933/1934 Securities Acts

could never have dreamed about the power they were unleashing with these

acts. So this is our interpretation of

what the SEC meant in their following quote:

“As more companies embrace

interactive data, sophisticated analysis tools now used by financial

professionals could become available to the average investor.”

In subsequent blogs we will discuss how to transform this

data into information.

0 comments:

Post a Comment